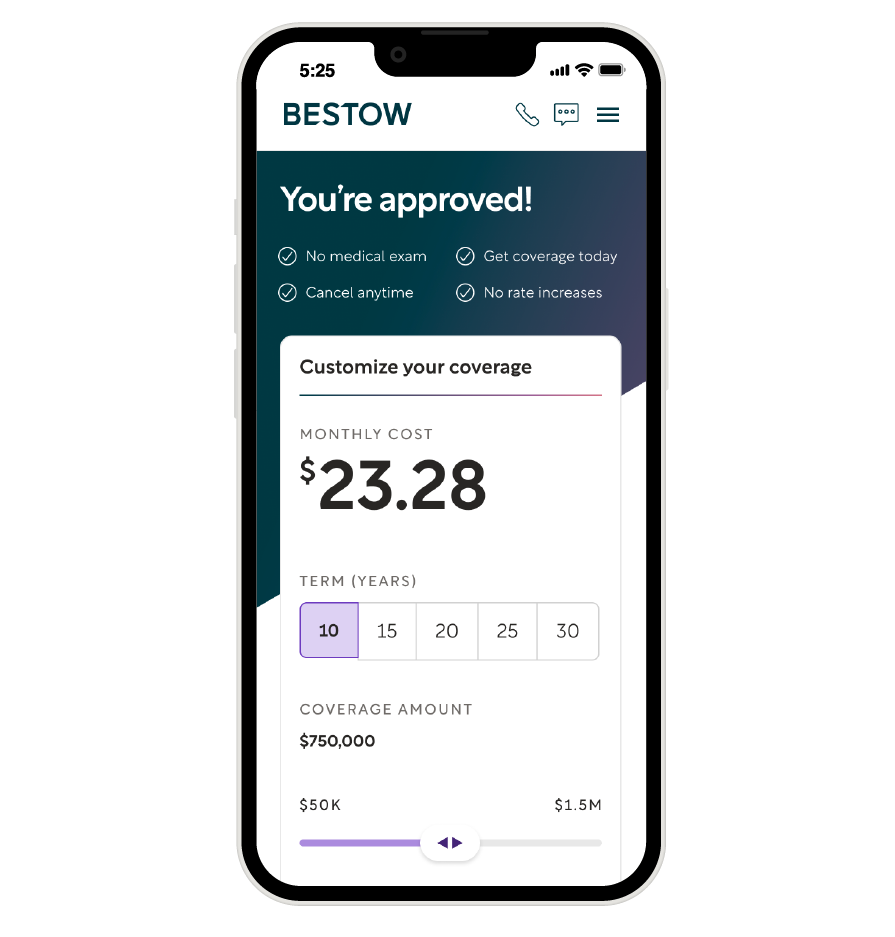

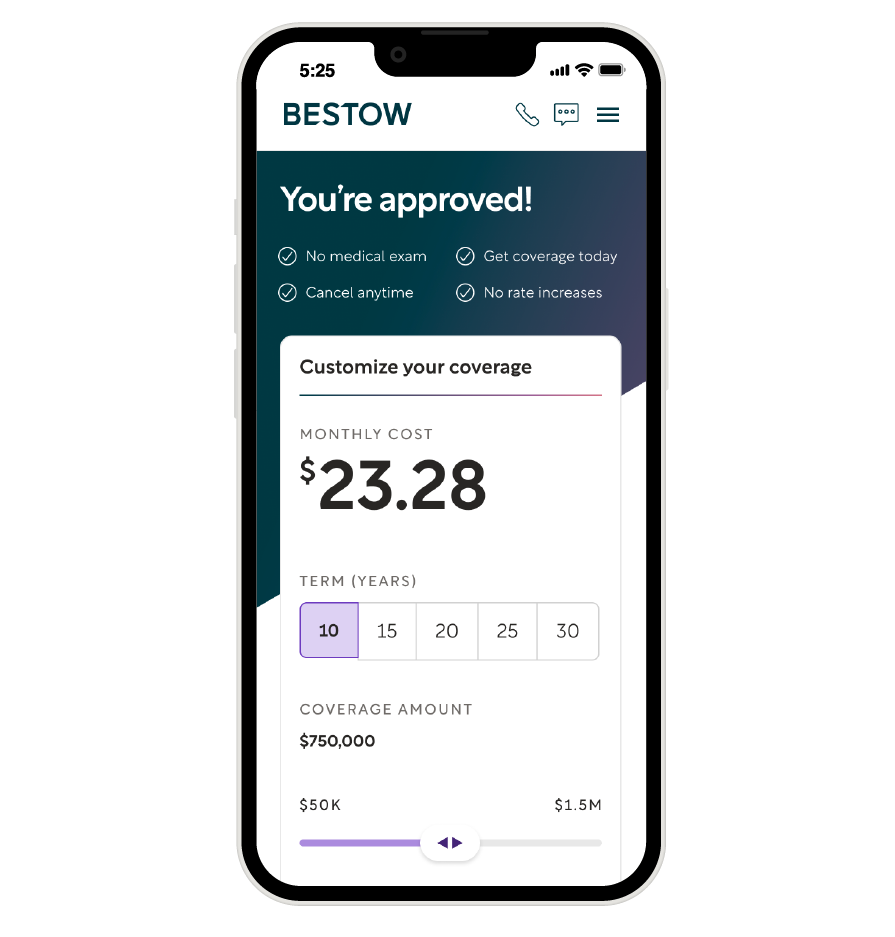

The first step is a fast, free quote

If you like what you see, apply in minutes and have coverage today, if approved.

Life insurance can help protect your family’s financial picture for decades — long enough to see you through big life commitments like paying a mortgage or raising kids.

Term life insurance is actually pretty simple. You make monthly payments and go about your life. If you pass away during your term, your chosen beneficiaries — like a spouse or kids — receive your death benefit amount as a payout.

Policies can start at just $11/mo. for up to 30 years of coverage.

Your policy provides protection during your term.

After an approved claim, the death benefit is paid to your beneficiary(ies).

If you were to pass away, how much money might your family need? Everyone’s situation is unique, but our coverage calculator can help give you an estimate of where your coverage needs may start. Curious about our math?

Disclosure:

Disclosure: The Bestow Term Life Insurance Calculator is for informational purposes only and is not to be construed as financial advice, nor is it intended to be a recommendation of specific insurance guidance products. Bestow shall not be responsible for any financial or investment decisions made as a result of any information generated by the Bestow Term Life Calculator. The amount of insurance generated by this calculator is an estimate only. The estimated amount of insurance is based upon the information you input into the calculator, as well as various other assumptions made by Bestow. You should speak to a financial advisor about any financial or investment-related questions that you may have.

If someone depends on your income to maintain their lifestyle, you’re a good candidate for life insurance. It could offer some financial protection to help your loved ones pay for things like a mortgage, college, or even a well-deserved break.

Help your family manage the mortgage without you.

Higher education or private schools

Help your loved ones maintain a comfortable quality of life.

Give your kids a leg up on their future with money for things like college.

A term life policy provides a set amount of coverage for a period of time that you select when you buy it.

That’s the “term.” It can range from 5, 10, even 30 years.

Term is cheaper than whole life, since coverage ends when the policy expires.

Term life insurance rates for some qualified applicants can start as low as $11/mo.

Permanent coverage is exactly what it sounds like. It remains in force until you pass away.

If you make all payments, the benefit, or payout, is guaranteed.

Given the eventuality of your death, carriers charge much larger premiums on whole life policies than term - often as much as 5X.

Answer a few health and lifestyle questions in as little as 5 minutes.

Most applicants get an instant decision. If approved, select the coverage and term that best fits your needs.

If approved, sign and pay to lock in your price.

That's it!

If you like what you see, apply in minutes and have coverage today, if approved.

Bestow makes applying for term life insurance a breeze. It only takes minutes and never requires a medical exam. If approved, you could activate your coverage as soon as today.

No hoops. No headaches. Just coverage.

A video featuring two people with helpful info on how to think about the amount of life insurance you might need.

Sometimes you just want to talk to a human. We get it. Book a 15-minute call with one of our licensed agents. They’ve got tons of helpful info and don’t work on commission — so they won’t pressure you to buy anything.

It might be today! Typically, the younger you are, the lower your premium will be. Prices generally go up the longer you wait to buy. But once you buy your policy, we’ll never raise your price during your term. We promise!

An animated chart that demonstrates how average life insurance premiums can get more expensive the longer someone waits to apply and purchase a policy.