How we helped increase D2C term sales 20%.

The ask

Our partner, a top life carrier, saw an opportunity to claim an even larger share of the term insurance market. To do so, they identified a number of goals:

- Grow membership and market share by increasing new policy sales, particularly for first-time life insurance buyers.

- Improve the digital application experience to reduce funnel friction and increase conversion rate.

- Introduce instant underwriting to offer customers faster decisions.

The solution

Working closely with stakeholders across this carrier’s entire organization, we aligned on key objectives and quickly began the development process. After just four months of development, demoing, and piloting, we delivered an elegant, market-ready digital product to our partner and its customers.

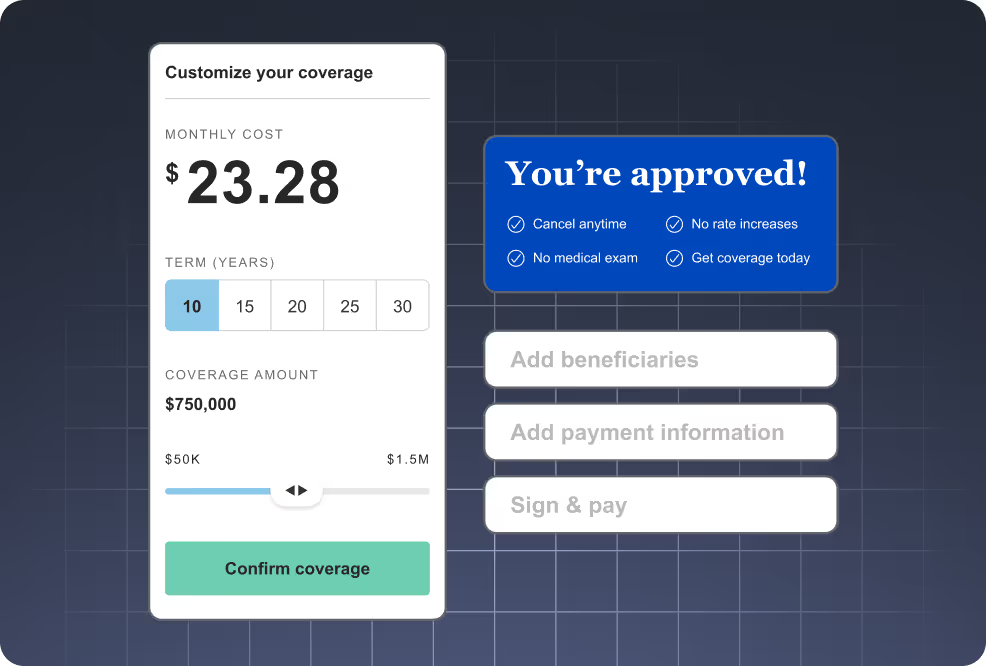

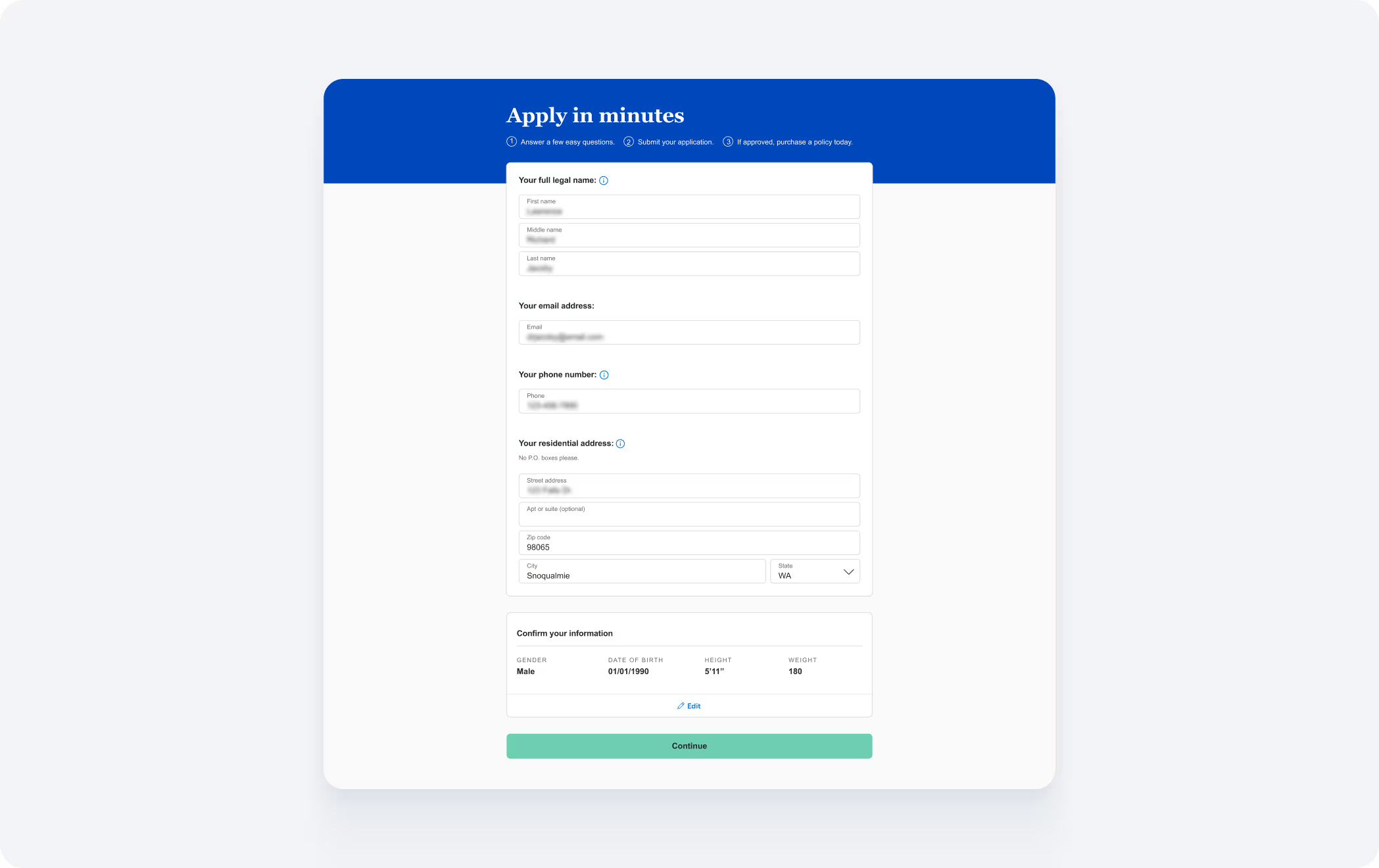

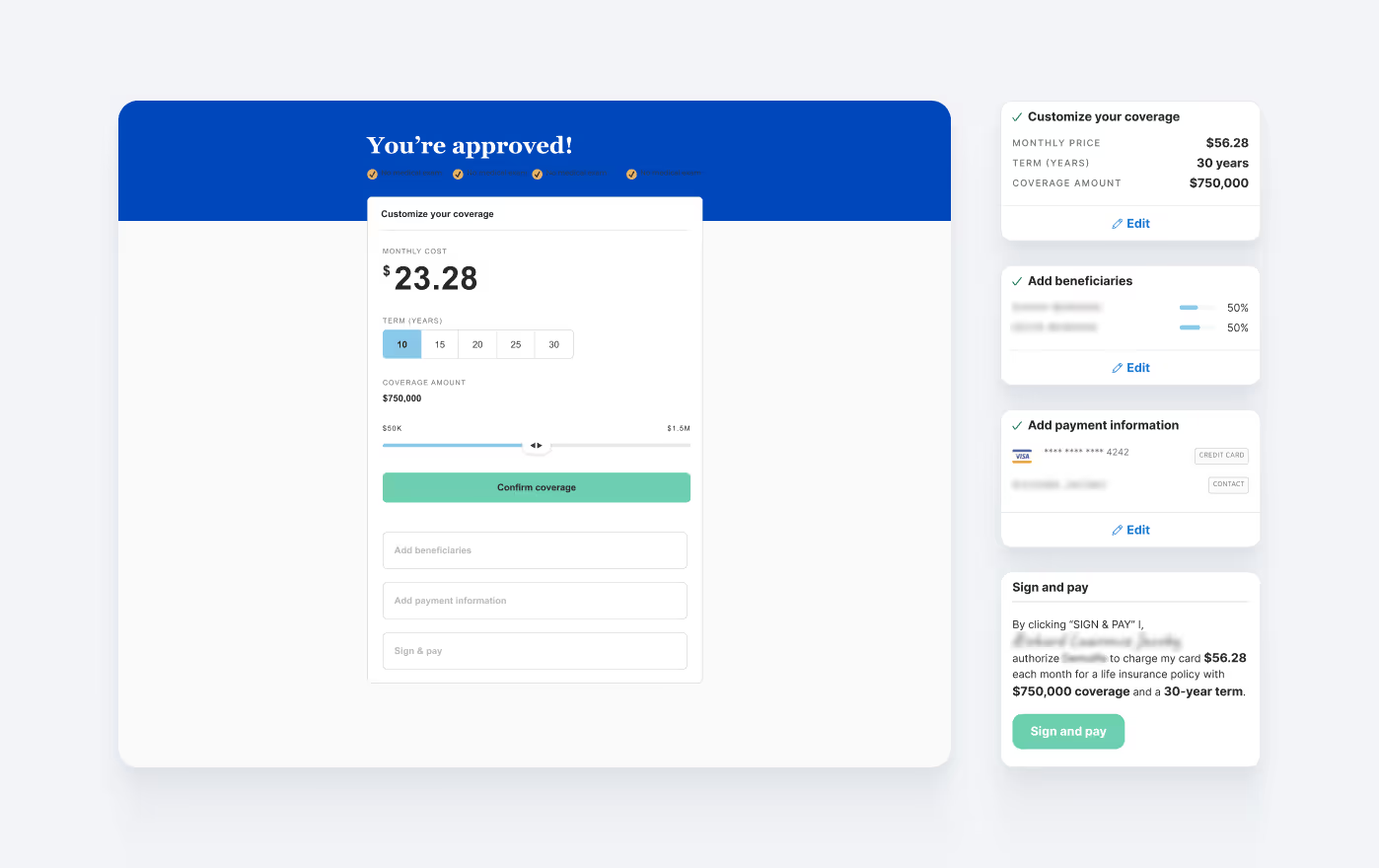

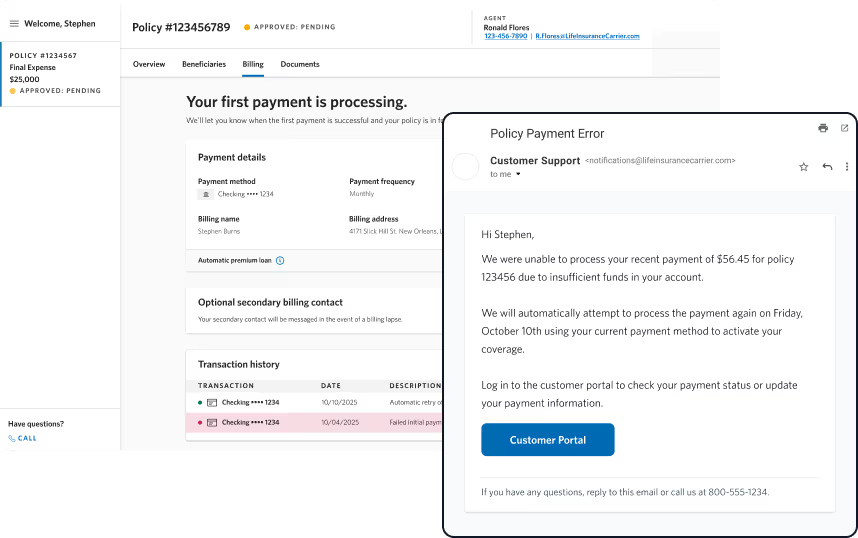

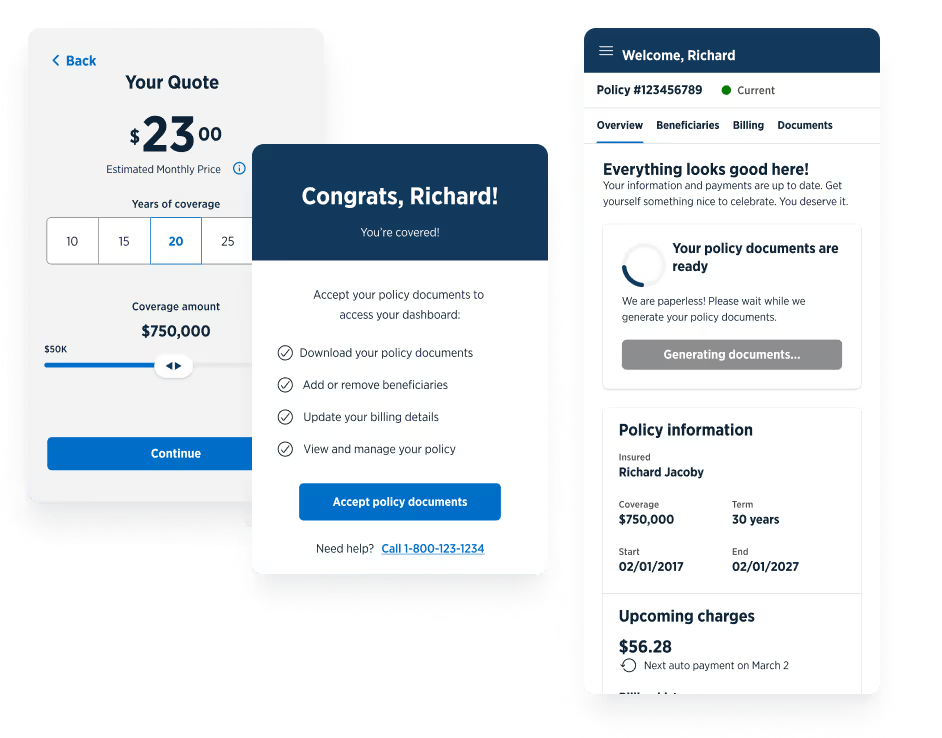

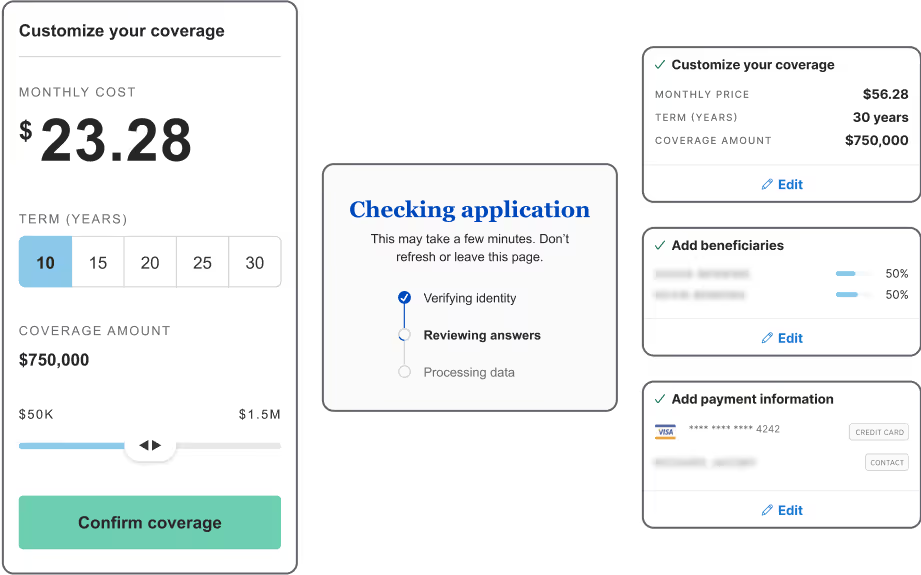

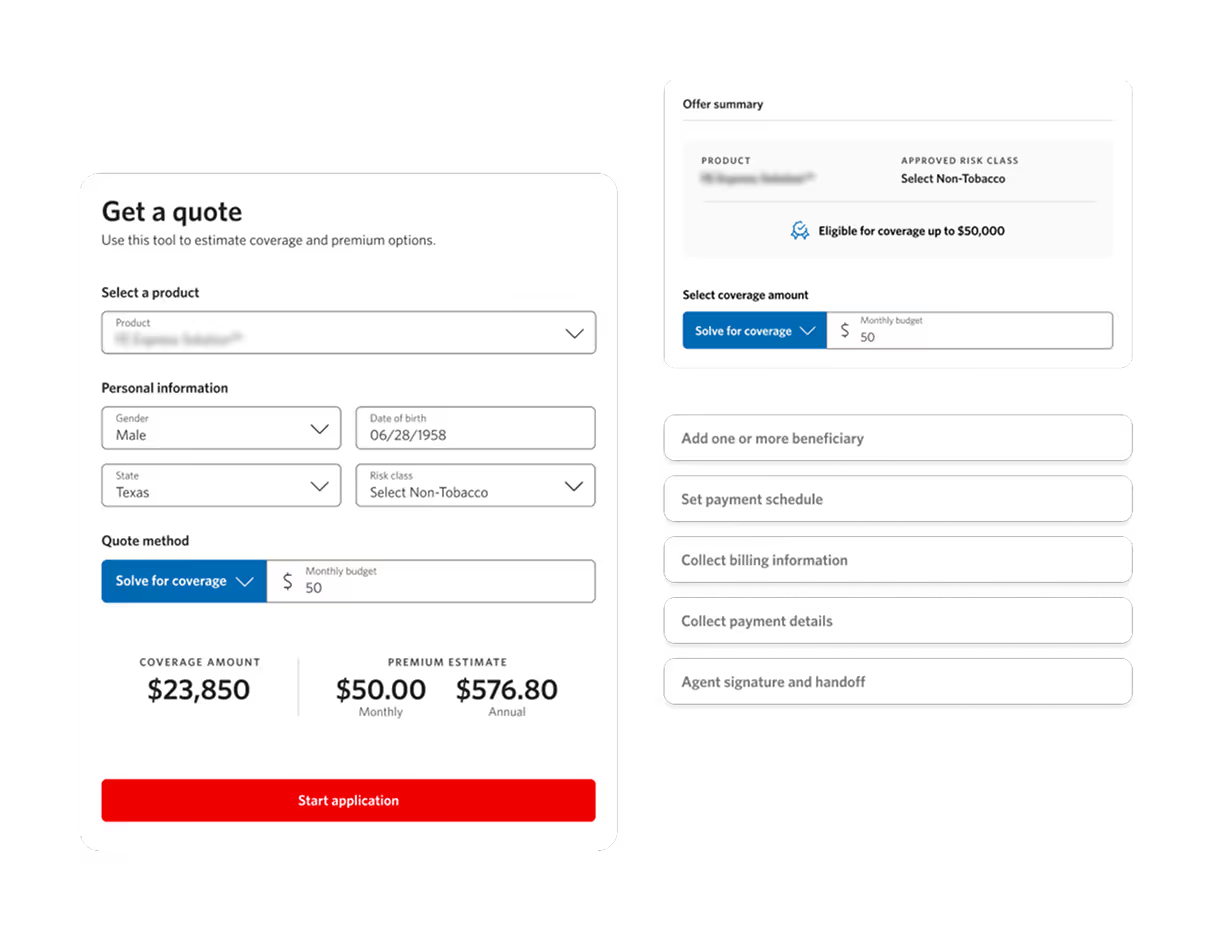

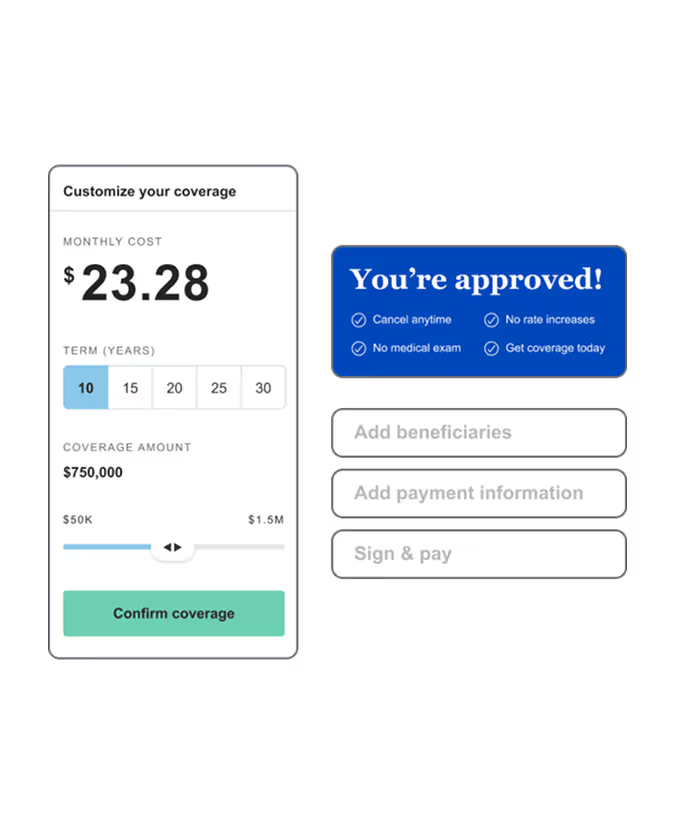

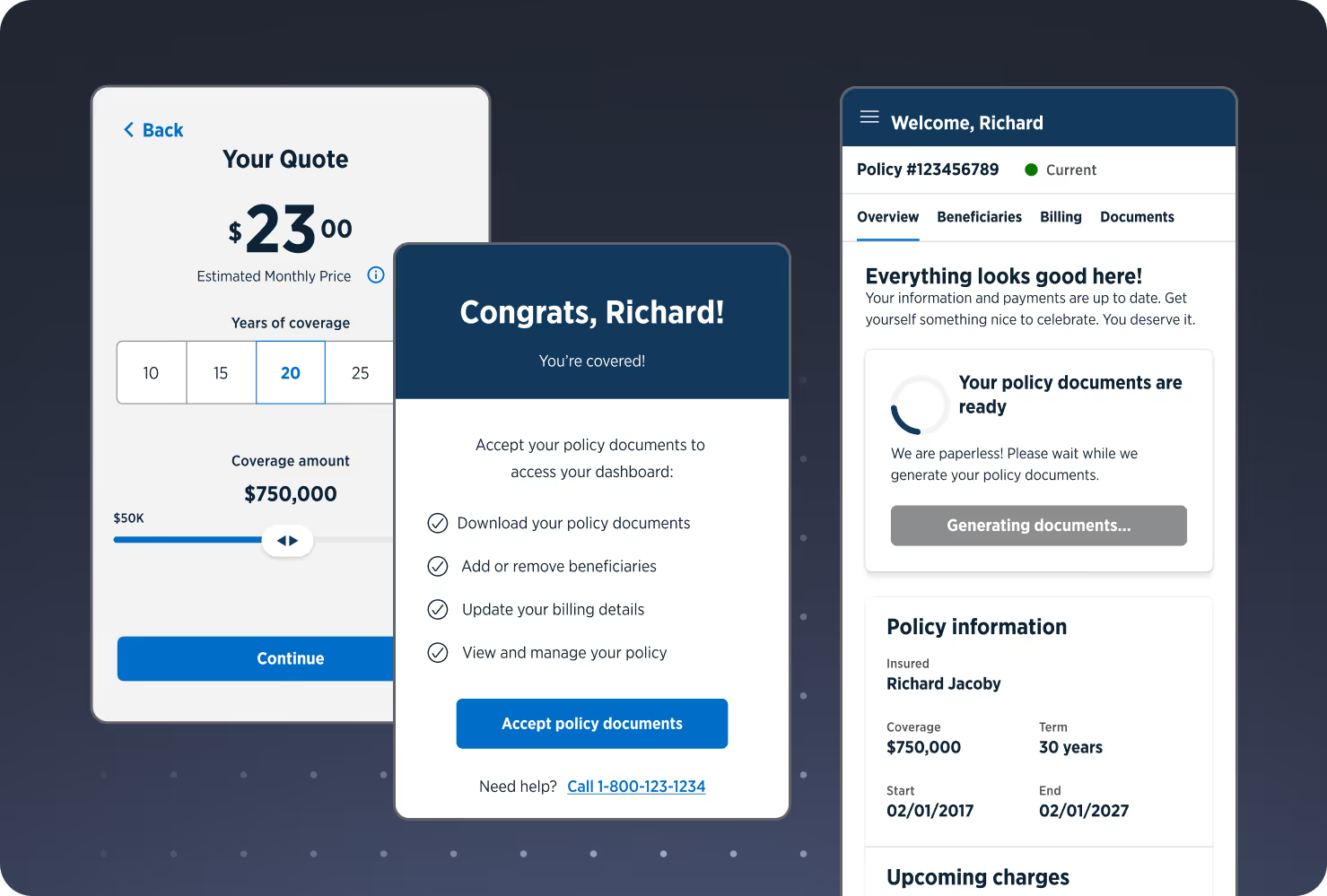

A frictionless purchase experience for customers

The ultimate measure of the usability of a digital product is how many people actually complete the process and how quickly. Leveraging Bestow’s Application Suite technology (which streamlines digital processes like quote, application, notifications, sign and pay, and even document delivery), this new product has dramatically reduced purchase friction, increasing conversion rate by over 200% (average compared to predecessor product), and allowing customers to submit an application in just 5 minutes (median).

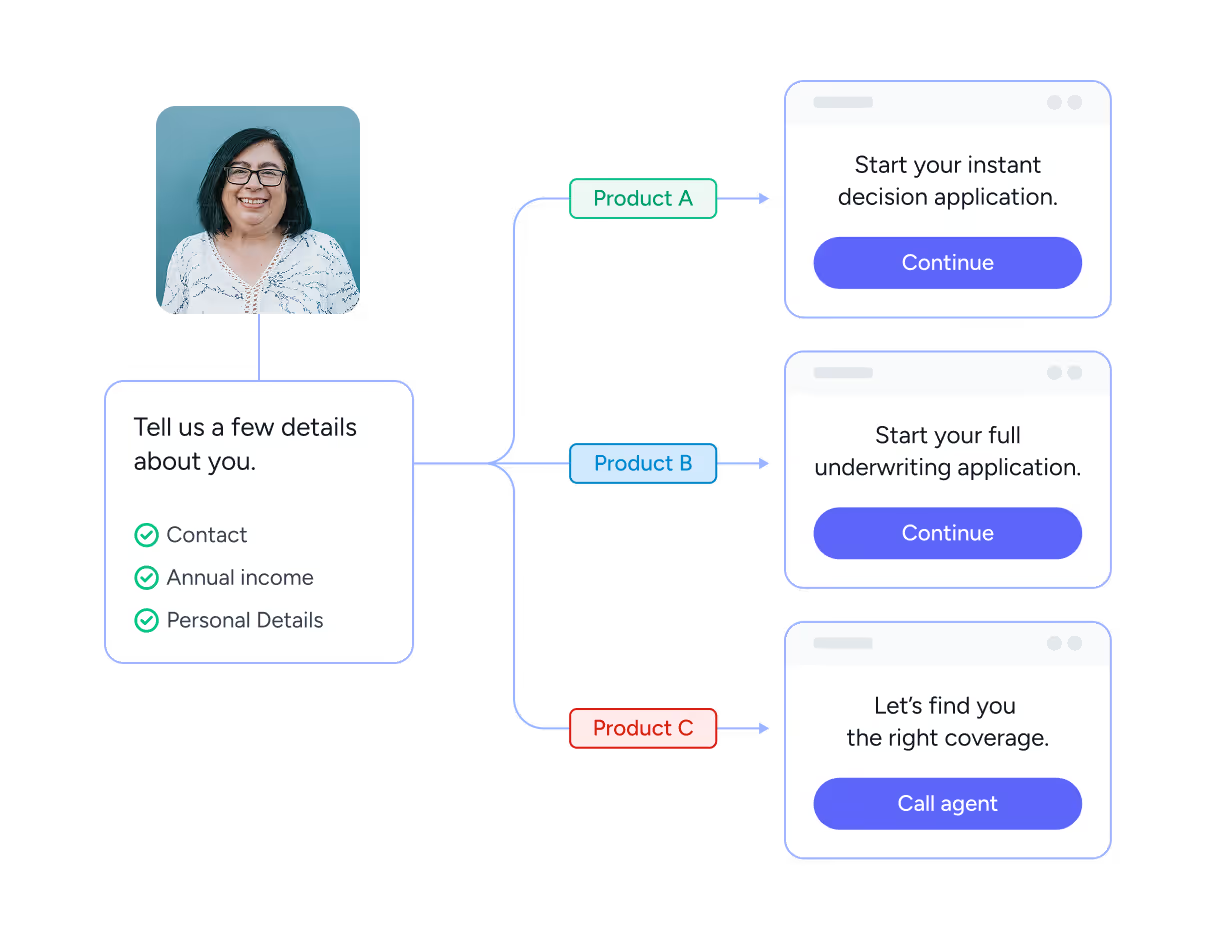

Hybrid instant/human underwriting

Our partner’s existing term product relied primarily on human underwriting. Together we zeroed in on a hybrid underwriting approach to reduce per-application costs and encourage sales through a faster experience. They set a goal of providing at least 50% of applicants with an instant underwriting decision. We are far outpacing that goal, with up to 87% of applicants receiving a decision in seconds.

Driving growth through policy sales

The speed and ease of this new digital application experience has played a central role in policy growth, exceeding our carrier partner’s previous comparable baseline by 70% (as calculated by new policy sales). This growth served an additional goal of reaching new, underserved customers in the life insurance market. To date, approximately 69% of customers are first-time life insurance buyers.

The results

Our solution has greatly enhanced the term life customer journey from start to finish, delivering real innovation and business growth for a top life carrier.

More customer stories

.svg)